Business

US shifts financial stability focus to economic growth, household security

Washington, Feb 6

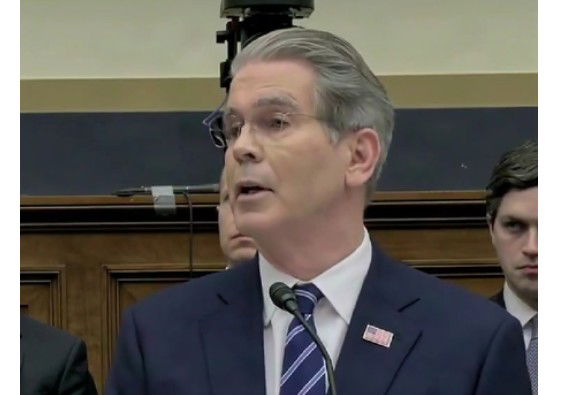

Treasury Secretary Scott Bessent has told lawmakers that economic growth and household security are now central to safeguarding the financial system.

Testifying before the Senate Banking Committee on Thursday, Bessent said the Financial Stability Oversight Council (FSOC) has moved away from what he called a reflexive approach to regulation. “Promoting economic growth and economic security is essential to ensuring financial stability,” he said.

The hearing marked the first detailed congressional examination of FSOC’s 2025 annual report. Bessent said the council is shifting its focus towards identifying specific vulnerabilities rather than broadly labelling large sectors of the economy as risks.

“Too often in the past, we’ve seen regulation by reflex,” he said, adding that regulators had acted as a “hazmat cleanup team instead of preventing dangerous spillovers in the first place.”

Bessent said excessive regulation can itself undermine stability by slowing growth and limiting opportunity. “Economic stagnation is itself a threat to financial stability,” he said.

Republican Chairman Tim Scott welcomed the shift, saying affordability and growth must move together. “A system that slows growth, limits opportunity, or prices families out of basic financial services is not a stable system,” Scott said.

Ranking Member Elizabeth Warren from the opposition Democratic Party accused the administration of weakening guardrails. “Congress created FSOC after the 2008 financial crash to protect families,” she said, warning that risks were being ignored.

Bessent rejected that view, saying past approaches had blurred priorities. “FSOC shifted away from its past approach where nearly every major market and financial sector was described as a financial stability vulnerability,” he said.

He said the council is now centred on strengthening household and business balance sheets. “Economic growth strengthens households, business and financial institution balance sheets, creating capital buffers that reduce the risk of defaults and financial stress,” Bessent said.

Lawmakers repeatedly clashed over the causes of inflation and bank failures.

Warren said rolling back oversight could invite another crisis. “The private credit market looks like a ticking time bomb,” she said.

Bessent said FSOC’s role is not to eliminate risk entirely. “Federal agencies must avoid the temptation to create a zero-risk financial system,” he said, calling it “the stability of the graveyard”.

FSOC was created after the 2008 global financial crisis to monitor systemic risks across markets and institutions. It brings together senior regulators from Treasury, the Federal Reserve and other agencies.

The United States’ approach to regulation and growth is closely watched by global markets, including India, where banks, investors and policymakers track US signals for capital flows and financial conditions.